ShmoopTube

Where Monty Python meets your 10th grade teacher.

Search Thousands of Shmoop Videos

Macroeconomics: Unit 4, Government Spending 1 Views

Share It!

Transcript

- 00:01

no macro economics Allah shmoop government spending governments What are

- 00:09

the good for absolutely something Well let's take a look

- 00:13

at government spending and I'll see if they're good for

- 00:15

anything Governments collect taxes and spend that money on goods

- 00:19

and services which hell in theory at least benefits the

Full Transcript

- 00:22

public and well they regulate Right Government regulates Stop a

- 00:26

subject for another video This spending and taxation though the

- 00:30

governments do directly affects the economy by injecting money into

- 00:34

it or while sucking money out of the system The

- 00:39

process of government spent here is complex It carries extremely

- 00:43

high volume in transactions and size and when economic weather

- 00:47

turns warm well the economic inputs are multiplied E sped

- 00:52

up made larger with a broader footprint Right hot economy

- 00:56

needs lots of spending and well that can get out

- 00:59

of control The technical name for these financial mosquitoes getting

- 01:02

horny er when the weather is hot it's called spending

- 01:06

multiplier When the government wants to promote economic growth it

- 01:09

can inject money or liquidity in the form of making

- 01:13

borrowing cheap into the economy in the form of its

- 01:17

own space And this spending multiplies as it trickles through

- 01:21

the rest of the economy Like you know government throws

- 01:24

a whole lot of parties and then employs lots of

- 01:26

bartenders Then buy a lot of beer in a leather

- 01:30

alcohol And then the bartenders get rich and then they

- 01:33

buy Ferraris They're something like another example Well let's say

- 01:37

the government wants to increase the real GDP by now

- 01:40

$10,000,000,000 small adjustment in our giant economy But well they

- 01:44

may want to make that increase Well why would it

- 01:47

want to target some numbered increase like this Well because

- 01:51

some bean counter with a phD at a Matthew model

- 01:54

that shows a more efficient economic and financial equilibrium at

- 01:57

that increased level of GDP versus well what's currently in

- 02:02

action Does the government have to spend $10,000,000,000 They hit

- 02:06

that optimal level or uh well say the government decides

- 02:09

it's time for roads and bridges and sidewalks to be

- 02:12

renovated Finally up until now the huge potholes well had

- 02:18

cost more to fix than they were worked But they

- 02:20

get bigger and bigger so well now with time we

- 02:23

gotta fix him So the government buys our contract with

- 02:26

subcontractors to buy concrete and metal And when Wilson paint

- 02:32

needle that potholes well it hires planners and designers and

- 02:35

construction workers to do the job And well guess what

- 02:38

The total expense to fix all those potholes comes out

- 02:41

to $1,000,000,000 So that's it The Big G spent $1,000,000,000

- 02:46

but they wanted 10,000,000,000 Is the optimal GDP growth target

- 02:50

Well what happened We're a 9,000,000,000 short Yeah well we're

- 02:54

not done with the story Hang on that $1,000,000,000 doesn't

- 02:57

just a stagnant Once the government has spent it and

- 03:00

as paid for the material in the wages of the

- 03:03

labor as well the construction workers might save some of

- 03:06

their salary and then spend it on a new car

- 03:09

or a new house or even just use it to

- 03:11

buy food and pay rent Then the grocery store employees

- 03:15

and landlords getting the construction workers money while they saved

- 03:19

some of their earnings and use the rest to buy

- 03:21

while other goods and services Right They save it for

- 03:24

about eight minutes and then spend it well The same

- 03:26

money continues to circulate around the economy many times over

- 03:30

so that the total increase in the value of goods

- 03:33

and services bought is much greater than that initial $1,000,000,000

- 03:38

Big G injection the size of the multiplier of this

- 03:41

semi trickle down vision of how the economy works then

- 03:44

changes in cold economies When people are scared and conservative

- 03:49

and just like to save their money for the rainy

- 03:51

days they know that are coming Well then the multiplier

- 03:54

might only be three or four times well in hot

- 03:57

economy is when people are optimistic about the future and

- 04:00

they feel secure in their jobs And they feel comfy

- 04:03

spending 38 1008 $183 on a new electric Tesla Well

- 04:08

then that multiplier might be closer than 10 11 12

- 04:11

times like that $1,000,000,000 becomes you know 33,000,000,000 Something like

- 04:16

that Well since each time some of the money gets

- 04:19

saved and the rest gets spent the scaling factor is

- 04:23

dependent on people's marginal propensity to save or MPs write

- 04:28

that down and know how to spell it And that

- 04:29

gets compared to their propensity to consume or mpc marginal

- 04:34

propensity consume right saving versus consuming while everyone's marginal propensity

- 04:40

to save might be different Well the government can use

- 04:43

the average MPs to get a rough estimate of the

- 04:46

scaling factor which they calculate as one over M ps

- 04:51

or set another way if the average MPs are marginal

- 04:54

Propensity save were 10.1 meaning people are saving 10% of

- 04:58

whatever they're gross income was well the initial injection into

- 05:01

the economy then get scaled up by one over 10.1

- 05:05

or by 10 a factor of 10 which means the

- 05:08

big G only need spend $1,000,000,000 on I'll say infrastructure

- 05:12

build instead of bartending for parties that $1,000,000,000 then would

- 05:16

have a factor of 10 behind it and raise the

- 05:18

GDP by yes $10,000,000,000 And we say on Lee here

- 05:22

with a smirk However if the MPs are marginal propensity

- 05:26

to save were 0.5 meaning people are really nervous People

- 05:30

are saving half their income after taxes Well then the

- 05:34

scaling factor would only be to write one over 10.5

- 05:37

is too So the government would need to spend $5,000,000,000

- 05:41

Teo get $10,000,000,000 in increased GDP All right so where

- 05:46

does the government get the money to change their spending

- 05:49

habits Well unless It has a rainy day fund a

- 05:51

k A surplus from budgeting to spend less than the

- 05:55

money they received through taxes Well then the government will

- 05:58

just have to borrow the money from somewhere Well an

- 06:01

alternative to just borrowing the money The government could decide

- 06:04

Tio well more or less create inflation It could run

- 06:08

the printing presses increased the money supply and well then

- 06:11

the inflation risk there is that it gets out of

- 06:14

hand And then if we have a hugely inflated currency

- 06:17

it would totally devalue the U S dollar globally and

- 06:21

well faith in the government And then that's a bad

- 06:24

thing So the government is very careful about how often

- 06:27

it runs the printing presses to just kind of create

- 06:30

more cash and supply So it's um or less stuck

- 06:33

with borrowing if it needs a lot of money today

- 06:36

to kind of prime the GDP well when the government

- 06:39

borrows money that money comes from the market for low

- 06:42

nable funds those air things like T bills and T

- 06:45

notes and other government paper The government can get money

- 06:48

internationally as well or domestically from banks and lenders by

- 06:52

issuing bonds just like you have to pay interest when

- 06:55

you go to the bank for a loan While the

- 06:56

government pays interest on these bonds however while individuals getting

- 07:00

a mortgage might be asking for money on the order

- 07:02

of tens or hundreds of thousands of dollars maybe millions

- 07:06

The government borrows money on the order of billions or

- 07:09

tens of billions of dollars And as of 2019 while

- 07:13

the US national debt stood it around 22 trillion dollars

- 07:17

Well since the government is such a big player in

- 07:19

the bond market where the government needs to borrow money

- 07:22

to fund its spending well it can raise the demand

- 07:26

for low nable funds and therefore the interest rate Basically

- 07:30

the biggie needing cash says instead of paying you a

- 07:34

3.232% interest a year on this paper well up the

- 07:40

anti and pay you 3.581% interest and then all of

- 07:46

a sudden insurance companies who must buy lots of government

- 07:49

paper while they all weighed in and trade their cash

- 07:53

for pieces of promissory paper from the U S Government

- 07:57

So when the government can increase the interest rates for

- 07:59

bonds that they loan out well The demand for bonds

- 08:02

probably goes up and they sell out Lots of people

- 08:05

are happy to take a little more interest from the

- 08:07

government because well they need the safety of Uncle Sam

- 08:11

being ableto taxes citizens and guarantee that the money will

- 08:14

be paid to insurance companies and old people Right Well

- 08:17

when the government raises the demand and the interest rates

- 08:19

on Lobel funds it triggers the crowding out effect I'II

- 08:24

where the high interest rates can prevent other people from

- 08:28

getting the loans they need anyway So yeah if you

- 08:31

ever see this guy walking through the mall with a

- 08:33

giant needle don't worry He's just looking to inject some

- 08:37

money into the economy No he's not a vampire different

Up Next

When you're about to marry the love of your life, not many things could stop you. However, finding out that your future hubby is keeping his crazy...

Related Videos

Here at Shmoop, we work for kids, not just the bottom line. Founded by David Siminoff and his wife Ellen Siminoff, Shmoop was originally conceived...

ACT Math: Elementary Algebra Drill 4, Problem 5. What is the solution to the problem shown?

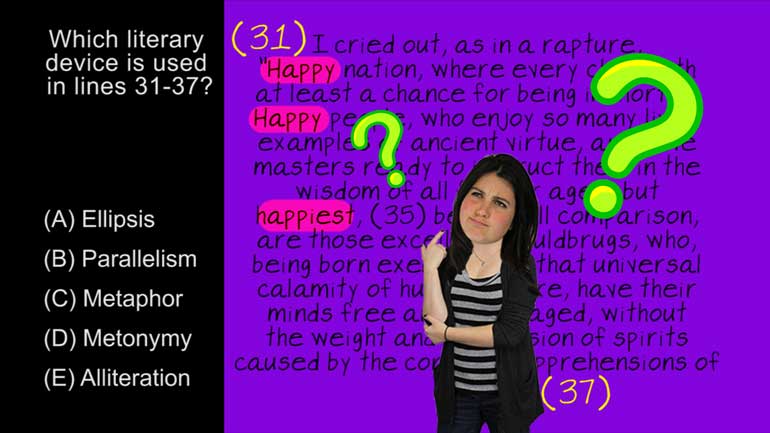

AP® English Literature and Composition Passage Drill 1, Problem 1. Which literary device is used in lines 31 to 37?

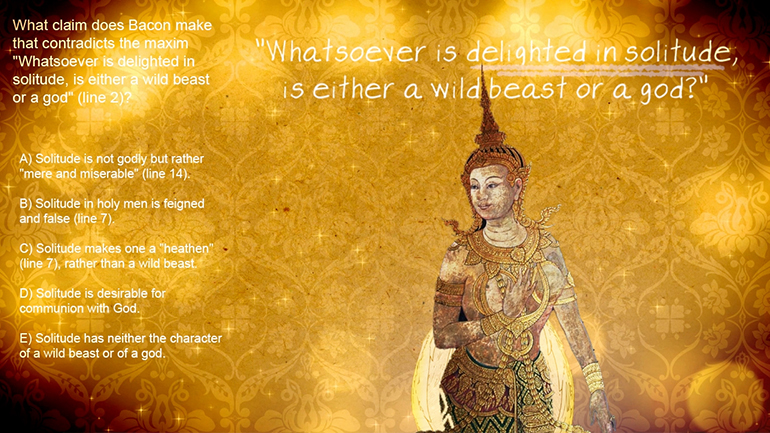

AP® English Literature and Composition Passage Drill 2, Problem 1. What claim does Bacon make that contradicts the maxim "Whatsoever is delig...