ShmoopTube

Where Monty Python meets your 10th grade teacher.

Search Thousands of Shmoop Videos

Macroeconomics: Unit 5, Monetary Policy 0 Views

Share It!

Transcript

- 00:02

macro economics Ah la shmoop monetary policy or our government

- 00:10

leaders just love to take credit for the economy when

- 00:13

it's good when it's bad Well of course it's somebody

- 00:17

else's fault But when the stock market's Hyeon unemployment's low

- 00:20

inflation is under control well everyone from the president on

Full Transcript

- 00:23

down to the lowliest intern here it shmoop like me

- 00:27

likes to take a victory lap But how exactly do

- 00:29

government officials influence the economy Well there are two Big

- 00:33

East The first is fiscal policy AII taxes in government

- 00:37

spending And the second is through monetary policy I eat

- 00:40

controlling interest rates and the amount of money sloshing around

- 00:44

in the system in and Yank Think of the two

- 00:47

is the leads in a buddy cop movie Alright well

- 00:50

fiscal policy is the young brash firebrand who just got

- 00:54

his detective shield He wants to kick in every door

- 00:57

and just wants to get the perp alone in a

- 00:58

darkened alley for five minutes We'll then there's monetary policy

- 01:02

The old crusty veteran carries a revolver He's named old

- 01:06

Betsy That guy makes use of snitches stakeouts and while

- 01:10

painstaking research to get the job done all the point

- 01:13

they both influence the economy but in very different ways

- 01:17

But they have different strengths and weaknesses right Sometimes they

- 01:19

work against each other and you can argue about which

- 01:22

one is better at getting the job done in different

- 01:24

environments or situations Okay so let's take a closer look

- 01:27

at the crusty old monetary policy Well in the U

- 01:30

S Monetary policy is run by the Federal Reserve It's

- 01:34

what's called a central bank Basically every currency has won

- 01:38

The euro has the European Central Bank The pound has

- 01:42

the Bank of England The yen has the Bank of

- 01:44

Japan The Monopoly Board has your cousin Jimmy who always

- 01:48

insists on being a banker and who always mysteriously seems

- 01:51

to have more hundreds than he should in brief monetary

- 01:54

policy controls the amount of money in an economic system

- 01:57

and how quickly that money moves through the system when

- 02:01

there's too much money or if the money's moving around

- 02:04

too fast or when both happened at the same time

- 02:07

Well they're serious likelihood or risk of inflation It's like

- 02:10

downing three quick double shot espresso so it's fun for

- 02:13

a while but eventually you're nursing a headache and wishing

- 02:16

you had stuck with You know the camera on the

- 02:18

other side of things If there's not enough money or

- 02:21

if the money moves around slowly sluggishly well then economic

- 02:25

growth will be sluggish as well It's like if you

- 02:28

overreact to that tickle in your throat and take a

- 02:30

double dose of cough syrup Suddenly keeping yourself from face

- 02:34

planting into your keyboard becomes your main point of focus

- 02:37

Well how does all this work in real life while

- 02:40

the Fed controls monetary policy How how did they do

- 02:43

that Well it sets base interest rates It can run

- 02:47

what's called open market operations which help control the amount

- 02:50

of money in the system like buying and selling bonds

- 02:53

And it can control bank reserve requirements Basically how aggressive

- 02:58

banks can get when loaning their money how much risk

- 03:01

they contain We'll touch on each of those in a

- 03:03

little bit But first a little contrast with fiscal policy

- 03:06

That brash hot head of economic influence fiscal policy uses

- 03:10

the federal budget and taxation to change government spending and

- 03:14

influence consumption By changing the federal budget in the tax

- 03:17

rates will the government can tryto push aggregate demand up

- 03:20

or down to affect inflation Unemployment and output in the

- 03:25

U S Fiscal policy is run by Congress and by

- 03:28

the president which means it's kind of a hodgepodge of

- 03:30

compromise and contradictory influences Voters have a closer influence over

- 03:35

the people in charge so fiscal policy can get moved

- 03:38

around by general sentiment After fly off the handle rough

- 03:42

up a suspect Ignore the niceties of securing probable cause

- 03:46

right well on the other side you've got monetary policy

- 03:49

which involves open market operations the discount rate and reserve

- 03:54

requirements But it's more interesting if we call him Detective

- 03:58

Fed So we will right Well Detective Fed using monetary

- 04:02

policy also tries to control inflation unemployment and output but

- 04:06

it uses different tools to affect the money supply Same

- 04:10

goal Different approach Fed officials are nominated by the president

- 04:13

approved by the Senate Just like judges And like judges

- 04:16

they get a bit of a cushion from public scrutiny

- 04:18

They don't get replaced all that off and and people

- 04:21

don't generally know what they do either So that's just

- 04:24

fine Kind of like the veteran cop They like to

- 04:26

take their time think about what they're doing and look

- 04:29

at the long term when economists talk about monetary policy

- 04:32

while they break down into two groups Expansionary monetary policy

- 04:36

and contractionary monetary policy Those two things that's the coffee

- 04:40

versus the cough syrup distinction and we're talking about expansionary

- 04:44

monetary policy well gets things going Contractionary monetary policy slows

- 04:50

him down well Another way to say it Expansionary monetary

- 04:53

policy is used when the Fed wants the economy to

- 04:56

grow Say things get sluggish Too many people are unemployed

- 04:59

and overall output is low You know it's a three

- 05:02

o'clock You're getting drowsy It's time for your afternoon cup

- 05:05

of Joe to push you through to the end of

- 05:07

the day Contractionary monetary policy on the other hand is

- 05:10

used when the economy is heating up too fast Inflation

- 05:13

is a big threat or at least a fear here

- 05:15

When there's a lot of cash floating around and trading

- 05:17

hands really quickly well the value of cash starts to

- 05:20

drop Usually prices go up It's a bad sitch and

- 05:23

now it's time for the medicine Well the Fed sees

- 05:26

that there's a potential problem brewing time for a little

- 05:29

cough syrup to get symptoms under control so the system

- 05:32

doesn't run into a bigger problem down the road We'll

- 05:35

that dose of syrup might slow them down in the

- 05:37

short term but they'll be better off in the long

- 05:39

term like same philosophy for contractionary policy right So to

- 05:43

keep inflation under control the Fed sucks money out of

- 05:46

the economy by issuing bonds and they put up restrictions

- 05:49

to the borrowing of money by raising interest rates Will

- 05:52

the Fed does all this magic by controlling what's called

- 05:55

the discount rate I'II more or less the interest rate

- 05:58

that banks charge each other or the rate that banks

- 06:01

get for borrowing money directly from the Fed while other

- 06:05

interest rates are influenced by this base interest rate As

- 06:08

the discount rate rises so do the rates consumer get

- 06:11

when they go to the bank Well this discount rate

- 06:14

allows banks too quickly and easily get cash directly from

- 06:17

the Fed often overnight to prevent bank failures which are

- 06:20

like a really bad thing well a bank and also

- 06:22

call up other banks to get money When the loaned

- 06:25

money is coming from other banks the borrowing bank pays

- 06:27

the federal funds rate usually in interest so by adjusting

- 06:31

the federal funds rate the Fed is able to control

- 06:33

rates for the economic system is a whole and to

- 06:36

make a profit of bank has to set its consumer

- 06:38

interest rates higher than the federal funds rate That's called

- 06:41

the spread well The Fed funds rate then becomes the

- 06:44

floor for all interest rates Consumer rates will be some

- 06:48

rate higher than that right There is a spread or

- 06:50

so money basis points above the federal raid that consumers

- 06:54

borrowing money to pay higher interest rates dissuade investors from

- 06:58

taking risks and putting their money into new capital projects

- 07:01

The economy slows down and unemployment increases or employment decreases

- 07:06

But inflation gets curbed and risks of bubbles and other

- 07:09

big problems for an overheated economy decrease In the 19

- 07:16

eighties there was an inflation rate of yes 15% a

- 07:20

month at one point Thank you Vietnam War spending machine

- 07:24

All right remember Ah high inflation rate is dangerous since

- 07:27

goods and services increase in cost very quickly which hurts

- 07:30

people who rely on fixed income I'II bonds and savings

- 07:34

And we're thinking about you Grandma and Grandpa retiree and

- 07:38

that whole inflation thing While it generally impact spending decisions

- 07:41

in a way that distorts the economy Like let's just

- 07:44

look at a quick example to see how higher interest

- 07:46

rates impact the cost of things Well a person with

- 07:49

a 30 year home mortgage for 300 grand with a

- 07:51

fixed interest rate of 6.5% would end up paying $682,000

- 07:57

in change On the other hand if interest rates were

- 07:59

to sky rocket from six and 1/2 percent two on

- 08:02

eight 18% then they would end up paying 1,000,000 6

- 08:05

100,000 bucks and change in interest And that higher interest

- 08:08

rate would mean having to pay almost $1,000,000 mawr in

- 08:12

the latter case toe pay off that high price alone

- 08:15

And you can imagine what that does to the price

- 08:17

of real estate Right High interest rates usually mean a

- 08:20

little state prices get crushed Well During the late 19

- 08:23

seventies and early 19 eighties old crusty Detective Fede put

- 08:26

his gun sights clearly on fighting inflation The Fed increased

- 08:30

the discount rate significantly Borrowing rates hit almost 20% for

- 08:35

a few months The downside recession Yeah nobody was spending

- 08:39

money on nothing and the wheels of the U S

- 08:41

Economy well ground to a halt But Detective Fede put

- 08:44

the handcuffs on inflation Eventually price increases fell to acceptable

- 08:48

levels of just a few percent each year Once the

- 08:51

economy exited the recession well was set up for a

- 08:54

strong healthy bull market and a whole lot of growth

- 08:56

And hence you had the boom of the 19 eighties

- 08:59

and nineties And yes look up the S and P

- 09:01

500 stock chart how bad it was in the seventies

- 09:04

and how good it was in the eighties and nineties

- 09:06

Well another element of economic control lies in the Fed's

- 09:09

regulatory grips on banks The US uses a fractional reserve

- 09:14

banking system which means that when someone walks up to

- 09:17

a bank and deposit 100 grand the bank keeps and

- 09:20

will say $10,000 of it in its big fat involved

- 09:23

And then it loans out while some of the remaining

- 09:26

90,000 bucks or maybe all of it with interest The

- 09:29

bank wants to loan out as much as possible That's

- 09:32

their business They make money on loaning out your money

- 09:36

toe other people and pocketing a spread or their share

- 09:39

of the interest right They're paying you 2% loaning out

- 09:42

at 8% and they're keeping 6% there as spread Nice

- 09:46

business right Well if a bank it's too aggressive They

- 09:49

Khun Kit in a bad position Like if something goes

- 09:51

wrong with those loans that too many people wanna withdraw

- 09:54

their savings Well banks can get caught without enough cash

- 09:57

on hand in their vault when people want it And

- 10:00

then oh panic This exact situation happened in 1930 is

- 10:04

the U S Slid into to the depths of the

- 10:05

Great Depression People ran to withdraw their cash money from

- 10:08

the bank and when they couldn't get it back well

- 10:11

their hard earned savings went down with the banks Yeah

- 10:14

banks failed and money was lost And what people thought

- 10:17

was safe turned out to not be safe And that's

- 10:19

really bad Okay well to prevent bank panics and failures

- 10:22

the Fed Institutes reserve requirements These rules mandate how much

- 10:27

of its deposits banks need to keep in their vaults

- 10:30

Well banks will have a minimum fraction of their deposit

- 10:32

in reserve and 10% 5% for present 8% Something like

- 10:36

that kind of rainy day fund So when people come

- 10:38

in to ask for their money it's there The Fed

- 10:41

can adjust these reserve requirements as needed overtime by setting

- 10:44

higher reserve requirements while the Fed then acts in a

- 10:47

similar way to raising interest rates Like banks just won't

- 10:50

have all the money to loan that they'd liked alone

- 10:52

And so the prices go up Right Supplies limited with

- 10:55

demand flat goes up anyway so the bottom line is

- 10:58

then credit gets restricted Wealthy economy that is less fuel

- 11:02

to grow and there's less danger of inflation and overheating

- 11:05

At the other end of the rainbow lower reserve requirements

- 11:08

open up additional funds for lending amore fuel More potential

- 11:12

growth like that Kasaba Melon example We always talk about

- 11:15

Think about what grocery stores incentivized to sell Those melons

- 11:19

that cost a dollar each were used to selling him

- 11:21

for $3 but now they've got 18,000 of them in

- 11:24

the store and they'll lower The price is really quick

- 11:26

to maybe a dollar 10 just to get him out

- 11:28

so you don't have a whole bunch of rotting melons

- 11:30

in the store And that's kind of how banks work

- 11:32

There's volumes of money that suddenly come in They dropped

- 11:34

the price of renting that money so that people borrow

- 11:37

It doesn't rot right Well in 2017 the reserve requirement

- 11:41

for banks with more than 115,000,000 bucks or so in

- 11:44

assets was at its highest which was a 10% reserve

- 11:47

right This means that those banks had to hold 10%

- 11:50

of all their assets in cash form Banks with less

- 11:53

than that were only required to hold 3% write really

- 11:55

small bank It's less volatile and less of an issue

- 11:58

to national security of the tiny bank goes bust Okay

- 12:01

well the final tool for the Fed is open market

- 12:03

operations almost with almost the Fed buys and sells government

- 12:08

securities in the open market Trading usually happens with large

- 12:11

institutional investors like Fidelity and Capital Group and Franklin those

- 12:15

guys and with other government When the Fed sells TV

- 12:18

lt's notes bonds and other forms of promissory paper on

- 12:21

the open market well they effectively suck liquidity or liquid

- 12:24

money from the economy by giving these illiquid papers out

- 12:28

in exchange for that cash On the other hand when

- 12:30

the fed vise back their own illiquid paper while they're

- 12:34

releasing cash money back into the economy increasing liquidity and

- 12:38

encouraging people to spend think of it like this They're

- 12:40

trading cash for paper when cash gets put into the

- 12:43

economy Well that's more money for businesses and consumers to

- 12:47

spend And when they take cash out of the system

- 12:49

well it's the opposite depending on the current economic landscape

- 12:52

while the fat will have to choose which tools to

- 12:54

use and how to use them using the right tool

- 12:56

can put the economy in a great position in the

- 12:58

wrong tool 12 hurts Fortunately the Fed has never screwed

- 13:01

up the entire economy but they have helped that a

- 13:04

number of times All right quick recap here All economies

- 13:07

go through growth and contraction over time It's natural It's

- 13:09

normal Monetary policy is conducted by the Federal Reserve By

- 13:13

changing the rate at which money enters the economy the

- 13:16

Fed can influence end or prevent recessions and inflation When

- 13:20

the Fed uses the correct type of monetary policy at

- 13:23

the right time it can flatten out the peaks and

- 13:25

valleys of the business cycle making it more gentle for

- 13:28

all of us That is we'll have longer periods of

- 13:31

growth and shorter periods of contraction with fewer extremes If

- 13:35

done right it's a matter of a slight adjustments performed

- 13:38

all the time over time at the right rate a

- 13:41

little boost of energy to get over the hump of

- 13:43

a long work week A slight cut in the federal

- 13:45

funds rate A little oom mow mow mow buying maybe

- 13:49

tweak reserve requirements a bit lower just a little shot

- 13:52

of caffeine Or the Fed could dispense a little over

- 13:55

the counter medicine to take care of a short term

- 13:57

cold that's slowing things down Maybe EJ interest rate a

- 14:00

bit higher Ah little almost selling and pick up reserve

- 14:03

requirements a little bit Expansionary monetary policy is used to

- 14:07

encourage the economy to grow It's caffeine time Then in

- 14:11

these situations we see lower interest rates lower unemployment and

- 14:14

higher inflation rates Contractionary monetary policy is used to slow

- 14:18

down the economy usually with an eye to controlling inflation

- 14:21

This type of policy involves higher interest rates higher unemployment

- 14:25

and lower inflation rates Got those big Three Well the

- 14:28

reserve requirement is how much the Fed forces the banks

- 14:31

to hold cash in reserve The discount rate is the

- 14:35

interest rate that the Fed charges for loaning money to

- 14:38

banks and the federal funds rate Is the interest rate

- 14:40

set for loaning money generally between banks Well almost are

- 14:44

the securities that the Fed buys and sells toe Add

- 14:47

a remove money from the economy and liquidity story There

- 14:50

Those are the tools used by you know crusty old

- 14:52

detective fed If things were going good he likes to

- 14:54

move slow build a strong case and keep things as

- 14:57

even keel is possible And let's just hope he doesn't 00:15:00.306 --> [endTime] get too old for this

Up Next

When you're about to marry the love of your life, not many things could stop you. However, finding out that your future hubby is keeping his crazy...

Related Videos

Here at Shmoop, we work for kids, not just the bottom line. Founded by David Siminoff and his wife Ellen Siminoff, Shmoop was originally conceived...

ACT Math: Elementary Algebra Drill 4, Problem 5. What is the solution to the problem shown?

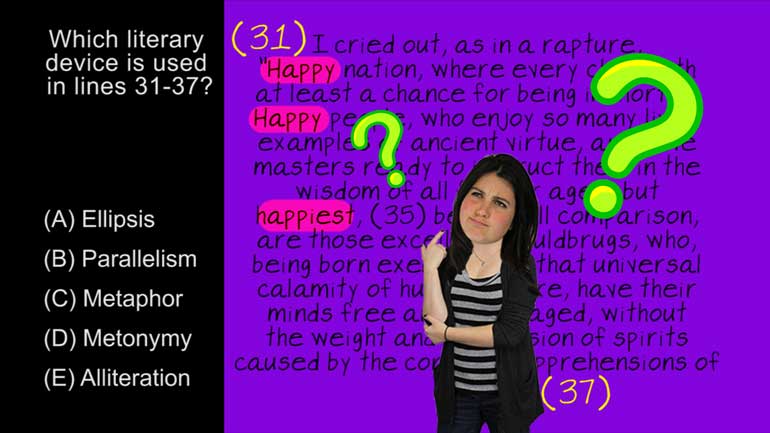

AP® English Literature and Composition Passage Drill 1, Problem 1. Which literary device is used in lines 31 to 37?

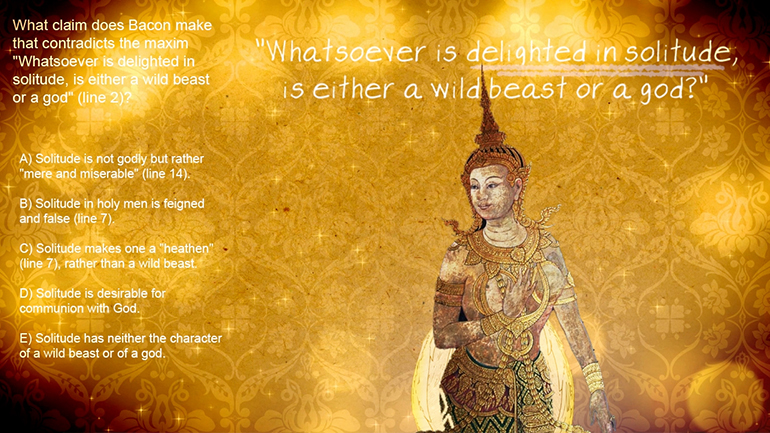

AP® English Literature and Composition Passage Drill 2, Problem 1. What claim does Bacon make that contradicts the maxim "Whatsoever is delig...