ShmoopTube

Where Monty Python meets your 10th grade teacher.

Search Thousands of Shmoop Videos

Macroeconomics: Unit 3, Real vs Nominal Variables 1 Views

Share It!

Transcript

- 00:01

no macro economics Allah Shma riel versus nominal variables Alright

- 00:09

people Bag of cash in your hand Black mask covering

- 00:13

your face You're looking like a really bank robber but

- 00:17

really is a relative right You sprint away from the

- 00:21

bank's revolving doors to the old pickup truck where your

Full Transcript

- 00:23

heist partner is waiting with the engine running Betsy got

- 00:27

well 10 miles to the gallon when your dad bought

- 00:29

her in the seventies and she still gets 10 miles

- 00:32

of the gallon today Tank indicator is so flexible it's

- 00:35

stretching back Asked E you're definitely gonna have to stop

- 00:38

to get gas And you're also definitely screwed You just

- 00:43

robbed a bank Yet you now have to pay four

- 00:45

bucks a gallon for gas to give Betsy a good

- 00:47

drink And you're wondering who really got robbed here You

- 00:52

know your dad used to tell you that he would

- 00:54

pay a whopping $10 to fill up the tank in

- 00:57

the day and now you're stuck paying upwards of $60

- 01:02

Well unfortunately for you you're still paying about the same

- 01:05

amount for the same tank of gas that your dad

- 01:08

was paying back in the seventies Yeah $10.60 dollars are

- 01:12

definitely not the same numbers But they were at least

- 01:16

for that tankful of gas So how does this make

- 01:18

any sense Well gas prices have been going up and

- 01:21

up enough and you've been paying Mohr for gas But

- 01:24

not really It's all about relativity That's right Einstein can't

- 01:28

claim all of the relativity discovery here Gently he left

- 01:32

some for The Economist When you pay $60 for a

- 01:35

tank of gas your paying a nominal price nominal as

- 01:39

in name That's what the NAM route is in Latin

- 01:43

there a nominal prices just the named price not adjusted

- 01:47

for inflation time nor anything else in economics Things are

- 01:52

measured in nominal in real terms Well so what's the

- 01:55

difference Inflation That's what that is Overtime In most venues

- 02:01

prices rise so you'll hear someone quote what a barrel

- 02:04

of oil costs at some point in history And you'll

- 02:06

wonder if that's uh today's dollars or like $1943 And

- 02:12

it's a big deal because in 1943 4 $112 bought

- 02:16

you like ah house Yeah well the big idea here

- 02:20

is the terminology For starters when economist measure value They

- 02:24

typically used two different terms Nominal in rial Nominal value

- 02:29

is the value of an object company bond or getaway

- 02:33

truck In any given year it's the name or numerical

- 02:36

value attached to the market clearing price of that object

- 02:41

while in 1968 a Big Mac cost 49 cents Oil

- 02:45

cost around a dollar 32 a barrel an average cost

- 02:49

of a new house Well it was about 15 grand

- 02:52

in 2015 The same Big Mac was 4 79 The

- 02:56

same barrel of oil cost around in a 50 or

- 02:58

60 bucks and the average cost of a house well

- 03:01

it was around $300,000 for that That same half their

- 03:05

yeah really Value is completely different It takes inflation into

- 03:09

a factor at least into account When calculating real value

- 03:13

we take the nominal value of an object and adjusted

- 03:17

for inflation right We take the name value and then

- 03:21

put it in context Well the real value of the

- 03:24

popcorn at the movies that now cost you $10.45 and

- 03:28

used to cost five bucks 25 years ago well remains

- 03:31

the same same relative price If there were roughly 3%

- 03:35

inflation every year over the past 25 years the cumulative

- 03:38

inflation would be this thing 5 25 3% 25 1.3

- 03:41

to 25th power about 209% total Right So the price

- 03:45

of popcorn in terms of dollars from 25 years ago

- 03:48

is the price now scaled down by the inflation or

- 03:52

10 45 divided by 2.9 or about five bucks Which

- 03:55

means the real value of popcorn has not changed well

- 03:59

An engineer at Hewlett Packard in 10 45 09 1968

- 04:01

who just moved to a nation Silicon Valley with apricot

- 04:05

orchards in downtown Los Altos back then is looking for

- 04:09

a home She has a salary of $10,000 a year

- 04:13

and the average house at the time costs in about

- 04:12

40 grand So about four times her annual cash pay

- 04:18

Fast forward to today And that's game Engineering position pays

- 04:22

about 200 grand a year and the median home price

- 04:25

in her part of the Bay Area is well over

- 04:28

one point 6,000,000 Will both the salary and home prices

- 04:32

have inflated over the past half century but home prices

- 04:36

have inflated at a vastly greater rate than did her

- 04:40

wages Well the average consumer buys products from a variety

- 04:43

of categories They pay for a house pizza new shoes

- 04:46

gas for the car medical care basketball game tickets student

- 04:49

loans and their phone bills among many other things if

- 04:52

they paid four grand for all their purchases in a

- 04:55

month in 2014 and they pay 4500 bucks for all

- 04:59

their purchases in the same month in 2018 while the

- 05:03

CP I between those years would be calculated as follows

- 05:07

So I've got the value of basket now invited by

- 05:10

the Value basket based year time 145 100 over 4000

- 05:15

times 100 there So that's one twelve 12.5 a C

- 05:19

P I have one twelve 12.5 means that there's been

- 05:20

12 and 1/2 percent inflation from 14 4018 That doesn't

- 05:27

mean 12.5% per year That means cumulative inflation So that's

- 05:33

compound inflation calculated as 1.125 equals well one plus X

- 05:40

to the fourth at that magic formula because it's compounded

- 05:44

over four years So then you just have to solve

- 05:46

for X and that's how you do it It's basically

- 05:49

the forth route of 1.125 and minus one there and

- 05:53

it gets you about 3% annually That's how we do

- 05:56

the math Your mop just kind of make things up

- 05:59

When studying a macro economy well you can look at

- 06:01

changes in GDP In other words the effects of a

- 06:04

rise in unemployment high inflation or increased productivity are closely

- 06:08

linked to the value of goods and services a k

- 06:11

a Gross domestic product But often the reported GDP might

- 06:15

not be exactly what it seems today That is Ah

- 06:18

country might report a 10% growth in one year in

- 06:22

GDP a huge number but you should be a bit

- 06:26

cynical and ask yourself if that's because they actually produced

- 06:29

Mohr goods and services produced more valuable goods and services

- 06:34

or simply raised the prices by running the printing presses

- 06:37

and churning out more money to create inflation To get

- 06:40

to that 10% figure If the nominal GDP grows by

- 06:44

2% but the inflation rates 3% well then the economy

- 06:49

actually relatively shrank by 1% That's why when economists studied

- 06:55

GDP they opt to use real GDP instead of just

- 06:58

nominal Basically economists look at the price of goods in

- 07:01

one particular year and use them to compute the GDP

- 07:04

for all subsequent years So when they look at changes

- 07:08

in real GDP which is to say always measuring GDP

- 07:11

and say $1973 then any changes aren't a result of

- 07:16

inflation Instead measuring everything in terms of the base years

- 07:20

dollars shows how an economy is really growing We love

- 07:24

graphs and nobody does graphs better than the Federal Reserve

- 07:27

Economic Data Division E Fred But one of the best

- 07:31

things about Fred is that we can compare to different

- 07:34

graphs what We've gone ahead and grabbed a snapshot of

- 07:37

one of those special combined graph So check this out

- 07:40

Okay so here we can see both the nominal GDP

- 07:44

just called gross domestic product The blue line there is

- 07:46

this thing and real GDP the redline That thing notice

- 07:51

how the real GDP growth was negative in 1975 even

- 07:54

though nominal GDP growth was almost 10% Well guess what

- 07:59

During the Vietnam War the global economy was starting to

- 08:01

really heat up meaning inflation was wrapped Billy rising well

- 08:05

to cool things off Jimmy Carter raised interest rates massively

- 08:09

which helped slow things down And while they fought and

- 08:11

eventually destroyed inflation you can see the Red Line is

- 08:14

a lot more volatile than the relatively steady blue line

- 08:17

Since that Red accounts for inflation and shows what's actually

- 08:21

going on Well that big drop in real GDP in

- 08:24

seventies shows that real output drastically fell Why isn't the

- 08:28

blue line is volatile Stagflation was rampant in the 19

- 08:32

seventies So is output fell the price level and inflation

- 08:36

rose The high inflation dampened the fall in nominal GDP

- 08:40

But real GDP accounts for the heightened inflation and shows

- 08:44

the real blow to the economy 10 bucks for a

- 08:46

full tank or 50 cents a gallon and you're paying

- 08:48

$60 for a full tank there or $3 a gallon

- 08:53

While there would have been a 600% inflation in gas

- 08:57

prices since 1970 using 1970 as our base here and

- 09:01

assuming everyone on ly consumed gas for breakfast lunch and

- 09:04

dinner well the CP I then would be 600 Yeah

- 09:08

you're paying for the same Think of gas that gets

- 09:11

you basically the same mileage But it just feels like

- 09:15

you're paying more Is the numbers higher Right Well the

- 09:17

number of dollars you're paying is Mohr anyway Yeah how

- 09:22

long it took you tow Earn those dollars Well may

- 09:24

be a lot less than it took dear old dad

- 09:27

to earn his 10 bucks And if you're thinking about

- 09:29

all this with your hands cuffed behind your back or

- 09:32

well you might start to think Hey maybe 20 years

- 09:35

in prison isn't so bad if it's just a nominal

- 09:38

right Well jail time unfortunately is not subject to inflation 00:09:43.797 --> [endTime] Just be sure to hold on to that sofa

Up Next

When you're about to marry the love of your life, not many things could stop you. However, finding out that your future hubby is keeping his crazy...

Related Videos

Here at Shmoop, we work for kids, not just the bottom line. Founded by David Siminoff and his wife Ellen Siminoff, Shmoop was originally conceived...

ACT Math: Elementary Algebra Drill 4, Problem 5. What is the solution to the problem shown?

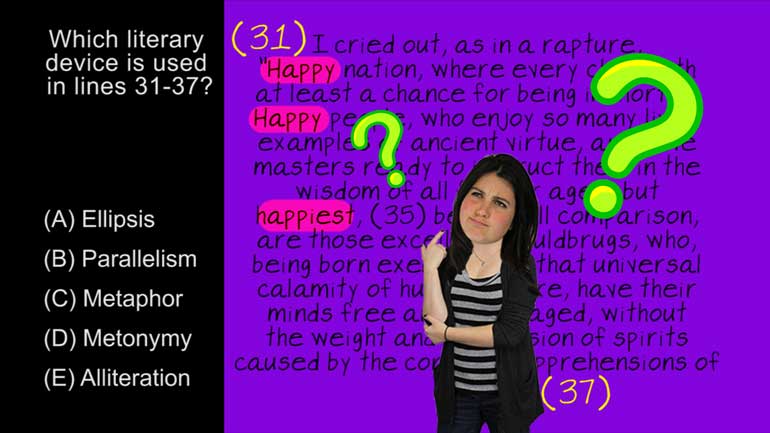

AP® English Literature and Composition Passage Drill 1, Problem 1. Which literary device is used in lines 31 to 37?

AP® English Literature and Composition Passage Drill 2, Problem 1. What claim does Bacon make that contradicts the maxim "Whatsoever is delig...