ShmoopTube

Where Monty Python meets your 10th grade teacher.

Search Thousands of Shmoop Videos

Macroeconomics: Unit 4, Taxation, and the Effect of Taxes on the Economy 0 Views

Share It!

Transcript

- 00:01

no macro economics Allah shmoop taxation Great word Well Ben

- 00:08

E Franklin once said that the only two things in

- 00:11

life that are certain are death and taxes And now

- 00:15

that they have gene editing while the only thing left

- 00:18

is taxes you know for certain all right well bleak

Full Transcript

- 00:22

Yes but Ben Franklin lived in an age when one

- 00:25

out of every two people died of syphilis So you

- 00:29

know it makes sense anyway Ben's niece Sally Franklin it's

- 00:32

his niece buys a fruity tooty ice cream She pays

- 00:36

a sales tax of that value added tax or a

- 00:40

sales tax When Mr and Mrs Quincy Adams buy a

- 00:43

house together and live on it for around while 30

- 00:46

years they pay property tax when you get that sweet

- 00:50

sweated for paycheck and noticed that a huge amount of

- 00:54

it was chopped off while you perhaps bitterly realised that

- 00:58

you do in fact pay income tax Federal state sometimes

- 01:04

city a looking at you their Manhattan well authorities in

- 01:07

most cases the government our kind of financial little parasites

- 01:12

Sorry guys Just keeping it real They don't actually produce

- 01:15

anything right like unless you called governing thing so they

- 01:20

exist on the taxes and hard work of the people

- 01:25

they want to get paid for their you know governing

- 01:28

work with no reason to be sensitive to the amount

- 01:31

of money they're spending or how efficient there spend is

- 01:35

or whether or not the value of that spend lives

- 01:38

beyond well the next election cycle Right Well anyway taxes

- 01:42

are the financial gasoline in the engine that the government

- 01:45

likes to run like that Think of it as the

- 01:48

blood that parasites sucked out of your leg when they

- 01:51

latch on And not all taxes air bad or wasted

- 01:55

of course other than the salaries of Congress people thie

- 01:58

taxes collected from the government well governed by moving cash

- 02:03

from the haves to the have nots through programs like

- 02:07

while Social Security is one of a Medicare Medicaid and

- 02:10

another some taxes are unavoidable Can't spends saying you know

- 02:14

death and taxes But not all taxes are strictly necessary

- 02:19

Sometimes people or companies we'll get tax as a consequence

- 02:23

for doing something bad Example Both companies polluting into a

- 02:26

local river the government may impose a tax to make

- 02:28

up for the social badness that the polluting is causing

- 02:32

So this tax creates all kinds of problems for the

- 02:35

company doing the polluting Why Because it competes internationally and

- 02:40

lots of second and Third World countries really don't care

- 02:43

if they pollute If the whole country is on the

- 02:45

doorstep of starvation why would they care about cancer causing

- 02:49

agents in the water that will only begin to show

- 02:52

up two or three decades from now So this tax

- 02:55

is kind of a dangerous weapon certainly in the Western

- 02:58

world if it's charged against us and Western countries who

- 03:02

are quote first world unquote who do care about you

- 03:06

know three headed fish and you know children having problems

- 03:10

from drinking the water downstream Well then how can those

- 03:13

Western companies compete against Somalia Why do they not care

- 03:19

Because their government is highly corrupt and essentially gates The

- 03:22

resource is that should be available to the common person

- 03:25

in the country So the common people aren't worried about

- 03:29

living to celebrate their 80th birthday there just helping to

- 03:33

survive to next week Okay moving on taxing pollution Well

- 03:37

assuming that the world was globally on the same page

- 03:40

would either force the polluting companies to make ICO friendly

- 03:44

decisions and raised prices Eventually making consumers pay for the

- 03:49

non pollution or well taxing pollution may force people toe

- 03:54

exit the business altogether And well then they'd buy the

- 03:57

supplies from foreign countries who will do more damage to

- 04:01

their people in the long run because well if they

- 04:03

don't those countries don't have a short run right The

- 04:06

people all starve and die and well what do we

- 04:09

do about this Yeah So things are never as simple

- 04:12

as they seem in the New York Times Okay so

- 04:14

taxation policy becomes a political football And while we know

- 04:18

taxes affect the economy we aren't able to perfectly manipulate

- 04:22

the economy's performance with taxes taxing bad behavior and using

- 04:26

proceeds to fix the things wrought by that bad behavior

- 04:30

Right Taxes don't save everything They just kind of like

- 04:34

a meld politics in one direction or another Well the

- 04:37

whole notion of resource reallocation is dictated by popularly elected

- 04:43

politicians leave a bad taste And while pretty much everyone's

- 04:47

mouths the hardworking educated financially successful compatriots I feel that

- 04:52

too much of their hard earned money is being allocated

- 04:56

to the lazy the Slava nly the seven deadly sinners

- 05:00

right while the poor feel that the wealthy have just

- 05:03

one too many private jets so nobody's ever happy Alright

- 05:07

trick is to keep everybody equally unhappy equally unhappy Yeah

- 05:12

so that we don't revisit that whole You know Les

- 05:15

mis thing where you hear the people sing and crowds

- 05:18

play soccer with former politicians Heads as effective as that

- 05:22

kind of revolution may in fact be okay Another quick

- 05:25

example Governments can use tax policy to affect the livelihood

- 05:29

of their people Weapon they deploy is known as fiscal

- 05:33

policy and its goal is to stimulate or slow down

- 05:36

the economy So when the government cuts income taxes people

- 05:39

generally have more disposable income to spend or save right

- 05:43

You were paying an average total tax of 27% on

- 05:46

the 100 grand of taxable income that you earned or

- 05:48

27 grand total Then tax there cut to given average

- 05:52

corporate tax of 22% Suddenly you keep an extra five

- 05:55

grand a year after taxes Wow that's a huge delta

- 05:58

in safe Think about five grand 400 bucks and change

- 06:02

a month free that you didn't have before What would

- 06:04

you do with it If the government wants to close

- 06:07

a recessionary gap well they or it can spend some

- 06:12

money that it collected from taxes And we'll have that

- 06:15

money percolate around the economy to scale up and hopefully

- 06:18

match the gap meaning that if GDP is hovering around

- 06:22

well 0.3% growth with fear of AH guy jumping into

- 06:27

Cold River shrinkage as GDP goes negative and into recession

- 06:31

territory which everyone hates for one reason or another Well

- 06:35

what do we do What do we do Well then

- 06:36

the government can quote spend its way out of trouble

- 06:40

unquote by ordering a bunch of road repair and the

- 06:43

new army tanks and water dams and piping and sewer

- 06:48

thing is and whatever other things that would spend money

- 06:51

on so that businesses when then I need to hire

- 06:54

workers sell stuff to the government and the world returns

- 06:57

to inflation fear rather than you know Coldwater Shrinkage On

- 07:01

the other hand governments can promote spending by giving workers

- 07:04

Mohr of their income to spend by cutting taxes hoping

- 07:08

with the workers will then provide the liquidity or the

- 07:10

economic stimulus in upgrading washing machines cars computers and buying

- 07:14

way better wigs Okay so how should the taxes collected

- 07:19

change to get this desired stable ish growth the economy

- 07:23

result that everyone seems to want well the first is

- 07:26

that they have to think about the multiplier effect Yeah

- 07:29

that's what it is Remember that five grand in sudden

- 07:32

savings via the big tax cut Well it has a

- 07:34

huge effect That guy now spends the five grand on

- 07:38

whatever a party is a grand The bartender bills 100

- 07:42

bucks that bartender spends the $100 on whatever's and whatever

- 07:47

spend on whatever you say have a positively vicious cycle

- 07:50

or a virtuous one depending on how you look at

- 07:53

it So how do you determine proper spending or tax

- 07:56

cutting slash levying levels Will the government again uses the

- 08:00

average MPs or marginal propensity to save to get a

- 08:04

rough estimate of the multiplier this time calculating it as

- 08:07

one over M P s like that or one over

- 08:12

one minus mpc since MPs is the same as one

- 08:16

minus MPC magic So if the average MPs is 10.1

- 08:21

and the tax multiplier is 10 so what effect does

- 08:25

this have on the economy when the government increases spending

- 08:29

GDP also increases and vice versa But when the government

- 08:32

increases taxes well disposable income decreases so GDP usually also

- 08:39

decreases The negative sign just shows that changes in taxation

- 08:43

and GDP happened in opposite directions right If a government

- 08:47

wants to close a recessionary gap of saying a $50,000,000,000

- 08:51

with MPs of 0.1 well the government could cut taxes

- 08:55

by a total of $5,000,000,000 just closed the gap Okay

- 09:00

quick and dirty recap Taxation is when the government takes

- 09:04

revenue from people and businesses Taxes are necessary to help

- 09:08

the government run And those taxes support lots of things

- 09:12

like social welfare programs in the military and pretty much

- 09:15

just everything the government does well Some taxes like sales

- 09:19

tax don't affect everyday life in a huge way on

- 09:21

their own Other taxes like income tax well can change

- 09:25

Everything is suddenly If the government raises or lowers taxes

- 09:29

it can completely change how the economy performs There are

- 09:33

many different theories and practices when it comes to taxation

- 09:36

Because no two economic scenarios are exactly alike There's no

- 09:40

way to know for certain which tax program's gonna have

- 09:42

the best effect And this is why there are huge

- 09:46

debates about taxation on the end You Khun Bet government

- 09:50

will not spend those dollars that you worked hard to 00:09:53.0 --> [endTime] earn efficiently

Up Next

When you're about to marry the love of your life, not many things could stop you. However, finding out that your future hubby is keeping his crazy...

Related Videos

Here at Shmoop, we work for kids, not just the bottom line. Founded by David Siminoff and his wife Ellen Siminoff, Shmoop was originally conceived...

ACT Math: Elementary Algebra Drill 4, Problem 5. What is the solution to the problem shown?

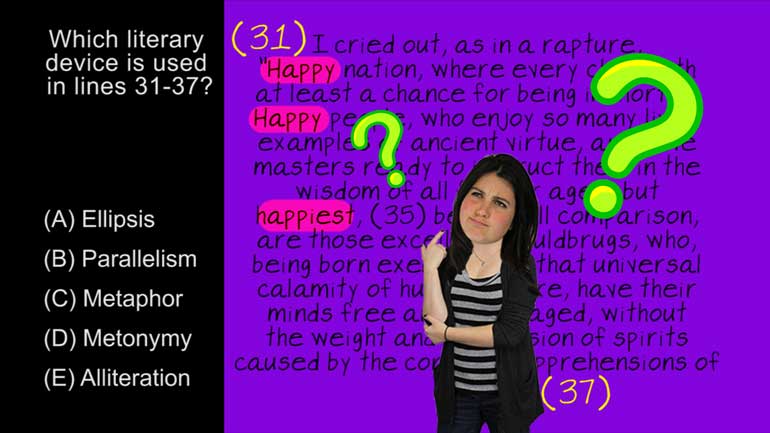

AP® English Literature and Composition Passage Drill 1, Problem 1. Which literary device is used in lines 31 to 37?

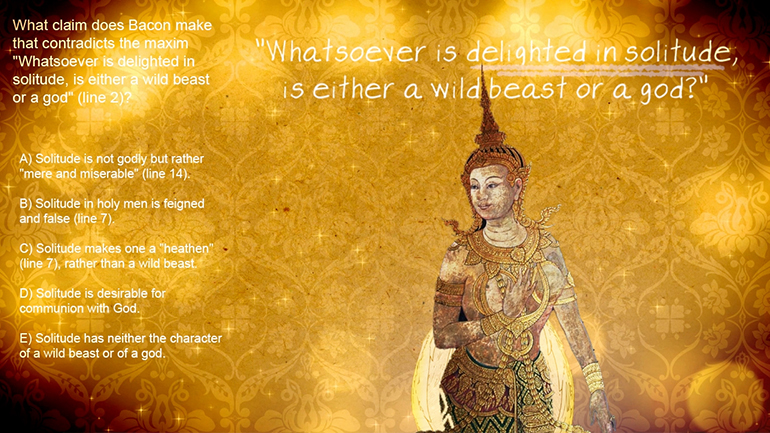

AP® English Literature and Composition Passage Drill 2, Problem 1. What claim does Bacon make that contradicts the maxim "Whatsoever is delig...