ShmoopTube

Where Monty Python meets your 10th grade teacher.

Search Thousands of Shmoop Videos

Macroeconomics: Unit 5, Banks 0 Views

Share It!

Transcript

- 00:03

macro economics La shmoop banks or uh thank you very

- 00:09

much Okay When a bank takes your money it reserves

- 00:14

some and it uses the rest toe by financial assets

- 00:17

Okay So what does all this mean while aren't reserves

- 00:20

what you spread on toast No actually reserving assets means

Full Transcript

- 00:24

that the bank will take some percentage of the 10

- 00:27

grand gift you just got from Grandmama and the bank

- 00:30

will loan out the rest Essentially banks multiply their financial

- 00:34

returns to shareholders who owned them They loan out their

- 00:37

deposits think money for shareholders and it's likely you're one

- 00:40

of them Will banks decide to carry highly varying levels

- 00:43

of risk and they then get varying levels of return

- 00:47

Conservative Bank of America might cap the maximum of which

- 00:51

they loan it only three times their collateral So if

- 00:54

they have $100,000,000 in equity or cash just sitting around

- 00:56

in the bank vault that you know bank robbers used

- 00:58

to rob that kind of fall then they might loan

- 01:01

up to $300,000,000 Well if they make a 4% spread

- 01:04

on that loan while then they can reliably expect to

- 01:07

have $12,000,000 in pretty safe loan revenues Well if riverboat

- 01:11

gambling Bank of the West lives at the opposite end

- 01:14

of the risk spectrum it also has 100,000,000 inequity But

- 01:18

it will loan upto 12 times that number in collateral

- 01:22

So that bank may loan upto one point $2,000,000,000 at

- 01:26

the same 4% spread meaning it cost them 2% to

- 01:29

get 6% for people They loan it D'oh Well they'd

- 01:32

expect $48,000,000 in revenues from their loans assuming nothing goes

- 01:37

wrong You think about that A moment The same collateral

- 01:39

base at the bank 100,000,000 for both B of A

- 01:42

and for riverboat gambler And that $100,000,000 gets B of

- 01:45

A on ly 12,000,000 in revenues while 48,000,000 goes to

- 01:49

riverboat So yeah you could make a lot of money

- 01:51

in the banking business if you're smarter and or lucky

- 01:54

So all this sad note that if a relatively small

- 01:57

handful of lone takers ah default Well then riverboat gambling

- 02:01

bank is uh you know swimming with the fishes So

- 02:04

how does this spread thing work Well like a bank

- 02:07

might have Ah 10% reserve requirement So think about how

- 02:10

that affects Grandmama's $10,000 deposit Well the bank keeps a

- 02:14

grand of it in their vault or more likely in

- 02:17

safe steady secure US government Very liquid paper you know

- 02:21

like T bills stuff like that That's a grand out

- 02:23

of Grandma's 10 grand And they find a home at

- 02:26

much higher rent than the T bill collections from Uncle

- 02:29

Sam for the remaining nine grand like let's say this

- 02:33

guy Joe Bob Billy who never graduated high school really

- 02:36

wants that 600 horsepower truck with thehe trailer hitch thing

- 02:40

and will happily pay 12% interest on the loan while

- 02:43

the bank then makes money in paying grandmama 1% on

- 02:46

her savings account dough and loaning money to Joe Bob

- 02:50

Billy A 12% note that the 11% spread on this

- 02:54

highly risky alone while they're right there on the 10

- 02:57

grand in the bank Well that's worth 1100 bucks a

- 02:59

year in kind of easy money or at least revenues

- 03:02

from the loan using Grandmama's money If the loan works

- 03:05

and the guy keeps paying off his truck while the

- 03:07

bank pockets all that money with not much more than

- 03:10

an envelope a stamp and an accountant Just checking the

- 03:13

numbers You might ask Why didn't Grandmama just directly loan

- 03:17

her money to Joe Bob Billy Well she could have

- 03:19

but Grandmama is not in the business of loaning money

- 03:22

So Joe Bob Billy didn't know to contact her And

- 03:25

in all reality Joe by Billy is way too high

- 03:28

of a risk for credit for grandmama to risk him

- 03:31

crashing into a tree and you know defaulting So that's

- 03:34

the structure of a bank Loans the spread What about

- 03:37

the logistics How does that bank keep track of all

- 03:40

this money and moving around Well they have to match

- 03:42

the money that comes in and the money that goes

- 03:44

out since they should in theory be you know equal

- 03:47

keeping track of this money is made easier with use

- 03:50

of a T account It gets its name from this

- 03:52

T shape the chart thinking that's what they look like

- 03:55

where they're liabilities a k What comes in on one

- 03:58

side of the tea than they have assets A k

- 04:01

What goes out on the other side Right All right

- 04:04

we're on the right side banks right down their liabilities

- 04:06

which usually our demand deposits from bank goers like banks

- 04:10

are responsible or liable for this money since customers deposited

- 04:14

with the trust that they can get it returned back

- 04:16

to them lickety split on the other side of the

- 04:18

T account the bank writes their assets this Khun B

- 04:21

required or excess reserves of cash stored in their vaults

- 04:25

Or it could be financial assets like bonds from the

- 04:27

U S Government or China or just some kind of

- 04:30

lone Well the important thing to remember is that any

- 04:32

changes toe one side of the team must match the

- 04:34

other side Let's take a look at the bank up

- 04:36

shmoop Well It has $10,000,000 in demand deposits which it

- 04:40

records his liabilities and the required reserves is 10% Note

- 04:43

that a demand deposit is dough that a customer can

- 04:46

demand be paid back to them more less at any

- 04:49

moment or within a few days Notice And it's why

- 04:52

you get lower interest rate on like a checking account

- 04:55

where you get your money immediately It's versus a savings

- 04:58

account where you have to give like six months notice

- 05:00

If you're going to take money out So one more

- 05:02

time just for those in the cheap seats Let's walk

- 05:04

through some math here Banker shmoop is required to have

- 05:06

at least 10% that's demand deposit stored in cash in

- 05:09

his vault Since it has $10,000,000 in demand deposit It

- 05:12

stores at the very least 1,000,000 bucks in cash as

- 05:14

reserve requirements But what does B O S do with

- 05:17

remaining 9,000,000 well in might store some of it in

- 05:20

its vault to be extra cautious as excess reserves like

- 05:23

it could be Mork conservative than it legally has to

- 05:26

be Or it could use that money to invest in

- 05:28

some financial assets like Bill West could convert the $9,000,000

- 05:32

into gold coins and swim in them like Scrooge McDuck

- 05:35

We love doing that which might be fun but not

- 05:37

the most financially savvy decision to make how Khun B

- 05:40

O S used that money more intelligently to make more

- 05:43

cash for its shareholders Well they could buy debt assets

- 05:47

even risky ones that pay high interest and they could

- 05:49

earn revenue on their money instead of letting it just

- 05:52

sitting evolved doing a whole lot of nothing One option

- 05:54

is to buy bonds from the U S Government Right

- 05:56

Investors presume the USG is trustworthy at least in terms

- 06:00

of paying back the money In fact the reliance on

- 06:02

the U S Government financial promises arguably the best asset

- 06:05

America has I even trust And it's based financially not

- 06:09

on what the government owned today but rather on its

- 06:12

ability to tax future revenues or assets of its citizens

- 06:17

Since we're almost guaranteed to get our money back from

- 06:19

a government bond was the U S Government one There

- 06:21

is low risk and understandably low reward like the interest

- 06:25

rates are low Okay well higher up the risk ladder

- 06:27

Live consumer loans The credit of Jerry the gambling plumber

- 06:32

is a lot riskier than the credit of Uncle Sam

- 06:35

Of course banks check credit scores and review loan recipients

- 06:38

to determine whether they're likely to pay back the money

- 06:41

or not But you know failures happen all the time

- 06:43

Note that with the extra risk banks charge higher interest

- 06:47

rates for the money they're loaning to the General Jerry's

- 06:50

of the world Instead of the 3% market rates on

- 06:53

US government bonds well banks charge Geri more like 556

- 06:58

and nine maybe 15% interest rates on loans to him

- 07:01

depending on the investing climate and how well or poorly

- 07:04

Jerry checks out on paper is a risk Okay so

- 07:07

with our $9,000,000 in excess reserves at the bank shmoop

- 07:10

let's say we've loan out 8,000,000 The excess reserves tab

- 07:13

on Artie account turns into $1,000,000 we add a new

- 07:16

loan section to our assets with 8,000,000 bucks right there

- 07:19

Well as this money gets paid back with interest we

- 07:22

get our money and then some So that's a look

- 07:24

at just one banks operations and accounts that $8,000,000 doesn't

- 07:28

flowed into the ether It gets invested in the capital

- 07:31

and eventually makes its way back to the bank Might

- 07:33

be a different bank or some of it could find

- 07:35

its way back to our very own Bank of shmoop

- 07:38

Banks sell loans to each other all the time Doesn't

- 07:40

matter which bank it's in It just matters that the

- 07:42

banks all over we'll see some of that 8,000,000 bucks

- 07:45

store Some of it is required reserve and then alone

- 07:48

the rest out again or at least a portion of

- 07:50

the rest Well initially there was $10,000,000 in the economy

- 07:53

The deposit tour always owned that $10,000,000 They just gave

- 07:58

it to the bank shmoop to hold for a bit

- 07:59

But when the boson loaned out that $8,000,000 Vivian's of

- 08:03

the 8,000,000 bucks get that money to spend into the

- 08:05

economy that means the total money supply just increased by

- 08:08

8,000,000 bucks They were getting to the multiplier Well This

- 08:12

system of saving a fraction of demand deposits as required

- 08:15

reserves and then loaning the rest out is called fractional

- 08:19

Reserve banking And it allows the money supply of the

- 08:22

nation in the world to multiply with each deposit to

- 08:25

a bank Well that $8,000,000 that got loaned out isn't

- 08:29

stagnant Remember it gets re deposited and re loaned again

- 08:33

and again and again If banks were alone out all

- 08:36

of their excess reserves and all of the loan money

- 08:39

got re deposited in Bank 12 the money supply would

- 08:41

be multiplied by one over the reserve requirement right There's

- 08:45

a minimum reserve banks have to keep Well you can

- 08:47

get to that multiplier using some fancy calculus and infinite

- 08:50

Siri's But the end result is that the greater portion

- 08:52

of a deposit that a bank can loan out the

- 08:54

bigger the multiplier in the bigger the change in the

- 08:56

money supply So if the reserve requirements 10% while the

- 08:59

money supply gets multiplied by a factor of 10 if

- 09:01

the reserve requirements 5% than its 20 and if the

- 09:04

reserve requirements 50% well then it's only multiplied by two

- 09:07

Well since the Fed controls the reserve requirement they can

- 09:10

control the scaling factor of banks in this country The

- 09:13

Maur the Fed requires in reserves the less money or

- 09:17

money supplied gets multiplied The more the Fed allows to

- 09:21

be loaned out the Mohr money gets supplied to the

- 09:24

world right We get mohr liquid the lower the reserve

- 09:27

will harm it is But that scaling factor is on

- 09:30

ly an upper bound Not all the money immediately makes

- 09:32

it back into the bank The multiplication effect of fractional

- 09:35

reserve banking depends on the idea that the money that

- 09:37

gets loaned out gets re deposited and real owned in

- 09:40

a cycle Theoretically all the money that goes out comes

- 09:44

back in But we don't live in the perfect ideal

- 09:46

theoretical land that many economists livin We live in the

- 09:49

harsh world of reality where well some cash gets stuffed

- 09:51

into couch is eaten by dogs or well it just

- 09:54

takes its sweet time to get Rita positive Well these

- 09:57

leaks in the cycle make the rial scaling factor last

- 10:00

than this theoretical won over the reserve requirement Oh and

- 10:03

by the way if you have a leak in this

- 10:05

cycle well you might want to swing into a gas

- 10:07

station for some inexpensively price toe hot air or you

- 10:10

could just swing by DC and being out of Congress

Up Next

When you're about to marry the love of your life, not many things could stop you. However, finding out that your future hubby is keeping his crazy...

Related Videos

Here at Shmoop, we work for kids, not just the bottom line. Founded by David Siminoff and his wife Ellen Siminoff, Shmoop was originally conceived...

ACT Math: Elementary Algebra Drill 4, Problem 5. What is the solution to the problem shown?

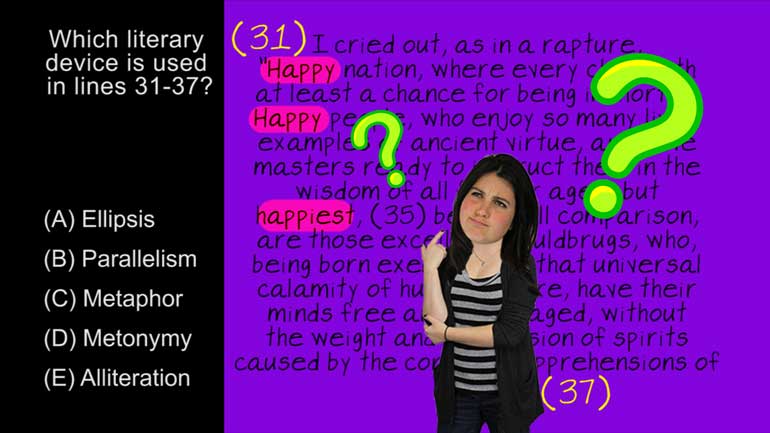

AP® English Literature and Composition Passage Drill 1, Problem 1. Which literary device is used in lines 31 to 37?

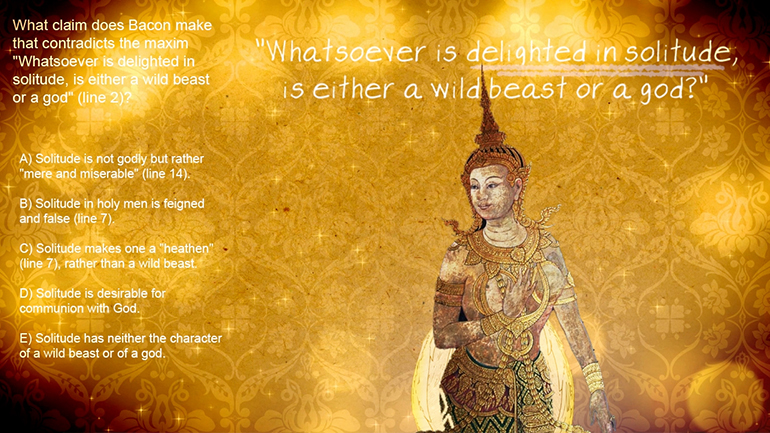

AP® English Literature and Composition Passage Drill 2, Problem 1. What claim does Bacon make that contradicts the maxim "Whatsoever is delig...